Startup AI spending reveals significant fragmentation across tool categories, with companies adopting multiple products rather than consolidating around dominant players in each market segment.

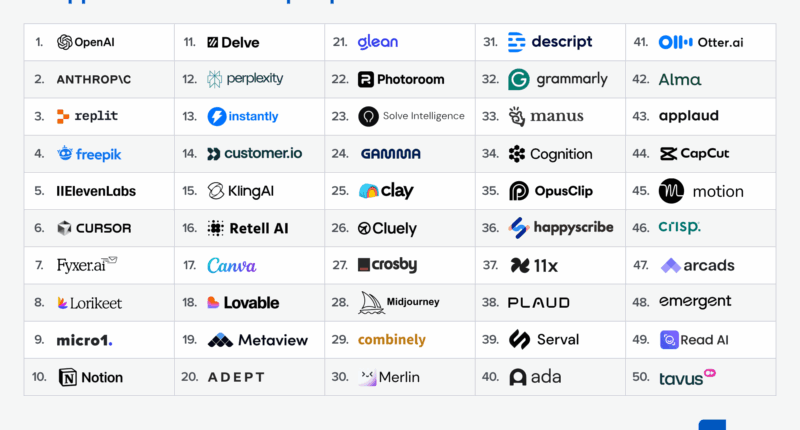

Andreessen Horowitz’s analysis of Mercury transaction data from over 200,000 customers shows this pattern across the top 50 AI application companies, reports TechCrunch.

The findings contrast with typical enterprise software adoption, where markets often coalesce around one or two dominant solutions per category. Instead, startups are experimenting with various AI tools simultaneously, particularly in areas like note-taking and coding assistance.

Seema Amble, partner at Andreessen Horowitz, said: “There’s a proliferation of tools. It hasn’t just coalesced around one or two in each category.”

The vibe coding space exemplifies this fragmentation. Whilst Lovable ranked higher than Replit in consumer web traffic, Replit generated approximately 15 times more enterprise revenue from Mercury customers due to superior enterprise features and functionality.

Olivia Moore, another partner at Andreessen Horowitz, highlighted the uncertainty: “It’s an open question going forward on vibe coding. Does the space start to consolidate, and one place becomes the best platform to vibe code? Or is it the case where there’ll be four or five more vibe coding companies that are really big businesses for different types of applications? We don’t have the answer to that yet.”

Consumer applications are transitioning to enterprise faster than previous software generations. Companies like CapCut and Midjourney, initially designed for individual users, are gaining enterprise adoption as employees bring personal tools into workplace environments.

The research shows most current AI tools function as “copilots”, augmenting human workers rather than replacing entire workflows. However, Amble expects this to shift: “As the tech gets better, and we’re actually able to build out full agent co-workers, you’ll see that mix shift more toward end-to-end agents and away from co-pilots.”

The landscape changes rapidly, with partners noting that “legacy” in AI contexts can mean products from just 12 months ago.