Wild swings in technology stocks that add tens of billions of dollars in market value within minutes are signalling an unhealthy market reminiscent of the dot-com era, according to a rising number of Wall Street professionals.

Advanced Micro Devices took a rocket ride on Monday as the company’s stock soared, briefly boosting its market capitalisation by roughly $100 billion at an intraday high after the chipmaker signed a deal with OpenAI that could lead to billions of dollars in revenue, reports Bloomberg.

The move follows a 36 per cent jump in Oracle shares last month, which added $255 billion to the software firm’s market value in a single session after it gave blockbuster guidance for its cloud business, including an agreement with the ChatGPT operator worth $300 billion over five years.

“If any one of these deals falls through it has this domino effect downstream that I think is concerning,” said Brian Mulberry, client portfolio manager at Zacks Investment Management, which has about $12 billion in assets. “It reminds me of what happened with telecom back in the mid-nineties.”

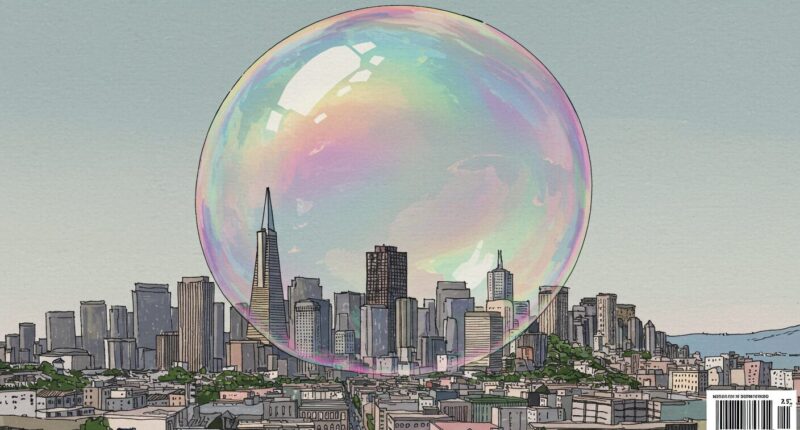

The moves come amid growing concern about a bubble forming around artificial intelligence as key players pledge billions of dollars in deals with companies making infrastructure for the technology. Top tech stocks now account for roughly 35 per cent of the S&P 500 Index, compared with less than 15 per cent in 1999.

“The market is pricing these deals as if everyone who transacts with OpenAI will be a winner,” said Michael O’Rourke, chief market strategist at Jonestrading. “OpenAI is a negative cash flow company and has nothing to lose by signing these deals. Investors should be more discerning. But this is a buy-first, ask-questions-later environment.”

Hedge fund billionaire Paul Tudor Jones said the current backdrop reminds him of the dot-com bubble in an interview with CNBC on Monday, adding that this environment is “more potentially explosive than 1999.”