With American leadership waning and a global ‘tech-lash’ building, the world is shifting towards a polycentric order where power is dispersed and democracy faces a deepening legitimacy crisis, writes Dr. Maha Hosain Aziz.

We are living through an era defined by geopolitical shifts, climate disruption and artificial intelligence. But the most consequential risks of the next few years will not come from any single crisis. They will emerge from how these forces interact – reshaping power, eroding trust and fragmenting systems.

The World Economic Forum’s 2026 Global Risks Report frames the current moment as an “age of competition,” marked by geoeconomic confrontation, information disorder and social polarisation. But the more compelling question is not what happens in 2026 alone – it is what will happen in the years to follow.

That was the lens of the 10th annual crowdsourced prediction project carried out by my graduate students at New York University in collaboration with experts at consultancy Wikistrat, where I’m a lead analyst. This exercise generated 277 risks and shocks, identified by 105 analysts from 22 countries.

From that research, four global risk trends stood out as likely to shape the path to 2030:

1. Power is becoming increasingly polycentric

American leadership is likely to be more selective and transactional over the coming years, with implications already visible in areas like security, climate and global health. This shift does not eliminate US influence, but it does reduce its role as the system’s default anchor. In doing so, it creates space – and pressure – for other actors to step in and fill the leadership gaps.

The result is not simply a multipolar world, but an increasingly polycentric one, where power is dispersed across multiple centres. In fact, in our project’s survey, only 37% of analysts expected the US to lead the world by 2030, compared with 70% who believed so for 2026.

Analysts consistently treated AI capability as a marker of strategic power. This is no longer just a US-China contest. Control over systems – data, chips, cloud capacity, platforms and payments – increasingly matters as much as territory or military strength. As a result, tech firms are no longer peripheral actors, but geopolitical ones. Middle powers are also growing in influence, helping shape norms and convene coalitions, not by matching superpower scale, but in targeting areas like AI.

The question is whether a more polycentric world will be able to secure global stability.

2. Democracy is entering a deeper legitimacy crisis

Global freedom has now officially been in decline for two decades, with more autocracies in the world compared with democracies. This raises an uncomfortable question: is democracy still seen as the best system within today’s world order? The core struggle is no longer only about elections or constitutional design. It is about whether institutions can still deliver security, fairness, opportunity and dignity. Legitimacy today is increasingly performance-based. When governance fails on cost of living, corruption, safety or opportunity, trust erodes – regardless of regime type. Gen Z protest movements worldwide reflect this shift. Many are less focused on abstract democratic ideals and more on dissatisfaction with governance outcomes.

At the same time, there are counter-signals. Younger candidates and movements are testing whether generational energy can translate into political power. Whether this renews democracy or intensifies instability will depend on whether institutions adapt – or simply resist.

What to watch in the coming years is not only election outcomes, but post-election legitimacy: acceptance of results, trust in courts and electoral bodies, and whether political polarisation and political violence become normalised.

3. The global monetary system is fragmenting

The world is not on the verge of waking up to a single replacement for the US dollar, as reflected in recent IMF data. The more realistic risk trend through 2030 is incremental fragmentation. The dollar is expected to remain dominant as the world’s reserve currency, yet diversification away from the USD is likely to accelerate. As geoeconomic tools – tariffs, export controls, sanctions and investment restrictions – are used more aggressively, more countries are actively considering their options. Alternatives to SWIFT are already in motion. Some countries are selling US dollar holdings to hedge geopolitical risk, while others – including India, the UAE and China – are expanding local-currency trade arrangements.

Our crowd analysis treated polycurrency less as a triumph for challengers and more as a global risk environment. While diversification can provide resilience, it can also increase volatility by creating currency mismatches, fragmented liquidity and faster contagion when politics shocks markets. Three drivers repeatedly appeared: weaponised economics and trade uncertainty; digital payment infrastructure, including central bank digital currencies; and the spread of private digital money.

The open question is whether the global economy can transition toward polycurrency without destabilising shocks.

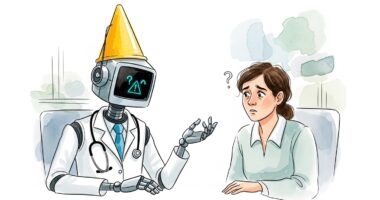

4. A global tech-lash is building

Across our analysis, anxiety about AI was not framed only as job loss. It was framed as an occupational identity crisis. Who are we without our jobs and careers if AI reshapes or removes them? Work is income, but it is also status, meaning and social stability. When technology changes what and who is valued, political consequences follow, potentially including mental health strains, social unrest and backlash against the technology itself.

Between 2026 and 2028, this crisis is likely to become more tangible as automation accelerates. But the tech-lash will also extend beyond employment into physical infrastructure. Data centres consume vast amounts of electricity, require grid upgrades, compete for water and carry climate footprints. Communities are already increasingly questioning who pays for this infrastructure and who benefits from it. Inside boardrooms, enthusiasm is giving way to tougher questions around governance, liability and return on investment. Concerns about AI-driven cyberattacks – including those enabled by more autonomous, agentic systems – are also growing.

From shifting geopolitics to eroding trust in the institutions that have sustained our societies, politicians and other leaders must be prepared. This convergence of economic, technological and security risks is approaching.

In many ways it has already arrived.

- Dr Maha Hosain Aziz is a professor, author and speaker in global risk and future trends based at NYU’s MA International Relations Program. This article was first published by the World Economic Forum.