SoftBank Group has agreed to acquire ABB’s robotics business for $5.375 billion as the Japanese technology conglomerate expands its artificial intelligence capabilities, declaring “Physical AI” as its next frontier in pursuit of artificial super intelligence.

The acquisition, announced on October 8, remains subject to regulatory approvals in the European Union, China, and the United States, with SoftBank expecting the transaction to close in mid-to-late 2026. ABB will carve out its robotics business into a newly established holding company in Zürich, with SoftBank acquiring all shares through a subsidiary.

The deal forms part of SoftBank’s strategy to invest across four essential areas: AI chips, AI robots, AI data centres and energy, alongside investments in companies at the forefront of generative AI. SoftBank stated the acquisition will significantly strengthen its AI robotics business by combining ABB’s globally recognised brand with its existing robotics-related investments, including SoftBank Robotics Group, Berkshire Grey, AutoStore Holdings, Agile Robots and Skild AI.

ABB’s robotics business employs approximately 7,000 people and generated revenues of $2.258 billion in 2022, $2.452 billion in 2023 and $2.279 billion in 2024. The division is known for reliability and high performance, supported by extensive sales channels and customer relationships. Marc Segura, currently President of ABB Robotics Division, will lead the carved-out business.

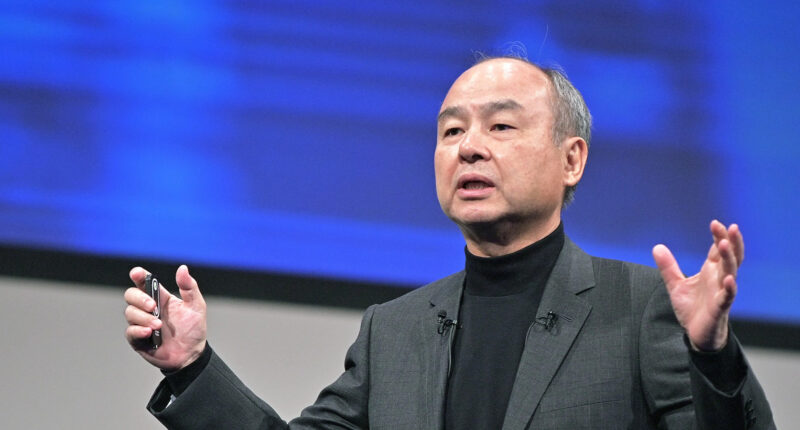

Masayoshi Son, Chairman and Chief Executive of SoftBank Group, said: “SoftBank’s next frontier is Physical AI. Together with ABB Robotics, we will unite world-class technology and talent under our shared vision to fuse Artificial Super Intelligence and robotics — driving a groundbreaking evolution that will propel humanity forward.”

SoftBank declared its mission to realise artificial super intelligence for the advancement of humanity as the centre of the information revolution enters a new phase led by artificial intelligence. The company stated it is well-positioned to reignite the robotics business’s growth through investment in cutting-edge technologies, with the platform, expertise and local footprint complemented by technological foundations from existing investments to accelerate innovation.

Morten Wierod, Chief Executive of ABB, said: “SoftBank will be an excellent new home for the business and its employees. ABB and SoftBank share the same perspective that the world is entering a new era of AI-based robotics and believe that the division and SoftBank’s robotics offering can best shape this era together. ABB Robotics will benefit from the combination of its leading technology and deep industry expertise with SoftBank’s state-of-the-art capabilities in AI, robotics and next-generation computing. This will allow the business to strengthen and expand its position as a technology leader in its field.”

The acquisition was approved by SoftBank’s Board of Directors on 22 September 2025, with final decision on terms delegated to Masayoshi Son and Yoshimitsu Goto, Corporate Officer, Senior Vice President, Chief Financial Officer. The purchase price remains subject to customary adjustments including net working capital and net debt at the closing date.

ABB, founded in 1988 and headquartered in Zürich, is a global technology leader in electrification and automation with consolidated total assets of $40.357 billion as of 31 December 2024. The company’s major shareholders include Investor AB of Sweden, UBS Fund Management and BlackRock.

SoftBank stated it will announce the impact of the acquisition on its financial results and the specific schedule once determined, noting that earnings forecasts remain difficult due to numerous uncertain factors.