Analysis reveals artificial intelligence companies are engaging in circular financing arrangements reminiscent of the vendor financing practices that contributed to the dot-com crash, with billions of dollars flowing between the same group of firms in complex dependency loops, reports the Wall Street Journal.

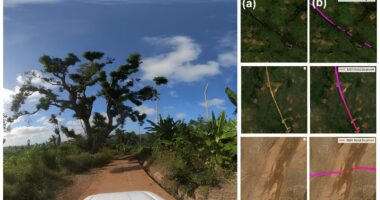

The arrangements see one company investing in or paying another, which then uses those funds to purchase the first company’s products or services. Morgan Stanley mapping of capital flows between six companies (OpenAI, Nvidia, Microsoft, Oracle, Advanced Micro Devices and CoreWeave) shows connections that analysts say resemble a plate of spaghetti.

Nvidia’s proposed $100 billion investment in OpenAI exemplifies the pattern. The investment helps OpenAI pay for infrastructure, whilst Nvidia stands to recoup money through chip sales to OpenAI, boosting its revenue. OpenAI recently agreed to buy $300 billion of computing power from Oracle over about five years. However, it remains unclear how OpenAI will secure all the funding, particularly if Nvidia’s investment fails to materialise.

AMD issued warrants for OpenAI to buy up to 10 per cent of AMD at a penny a share to secure OpenAI as a customer, essentially paying OpenAI to become a buyer despite expecting tens of billions of dollars in revenue from the arrangement.

Investments and IPOs

The complexity extends to CoreWeave, an AI cloud infrastructure company where Nvidia owns about five per cent and has committed to purchase any unsold cloud computing capacity through 2032, effectively backstopping its customers. CoreWeave’s biggest customer is Microsoft, which is an investor in OpenAI, shares revenue with OpenAI, buys chips from Nvidia and has partnerships with AMD. OpenAI also invested $350 million in CoreWeave before its initial public offering.

The arrangements parallel vendor financing practices during the late 1990s and early 2000s, when telecom equipment makers extended credit to customers for gear purchases. Lucent Technologies lent billions to upstart telecom providers building infrastructure, fueling rapid sales growth. However, when customers went bust, Lucent had to write off bad debts and book huge losses.

The risk for companies such as Nvidia and Microsoft is being hit twice if enthusiasm for data centre spending wanes (with less revenue coming in and declining values for equity investments in customers). The deals can work fine until investors grow tired of companies pouring capital into developing AI models and products with little visibility into future returns.