Global chief economists gathering at the World Economic Forum (WEF) this week have issued a stark double-edged forecast for the year ahead — while artificial intelligence is poised to deliver massive productivity gains, markets should brace for a painful “reckoning” as the AI investment bubble prepares to burst.

Two reports released in the run-up to the annual meeting in Davos this week outline a consensus that while the technology’s long-term economic value is real, the current financial hype cycle is unsustainable.

“Irrational exuberance”

In a detailed analysis titled Anatomy of an AI Reckoning, Paul Donovan, Chief Economist at UBS Global Wealth Management, warns that the current investment cycle displays the classic “irrational exuberance” of a financial bubble.

Donovan outlines a theoretical timeline for this correction, predicting that the bursting phase would be a primary financial market event focused heavily on the United States.

“By definition, a bubble results in investments that fail to achieve promised results,” Donovan writes. He notes that as the bubble deflates — a period he marks as “T-plus 2 months” — wealth will transfer from bubble buyers to sellers, and speculative firms dependent on cheap capital will face inevitable job losses.

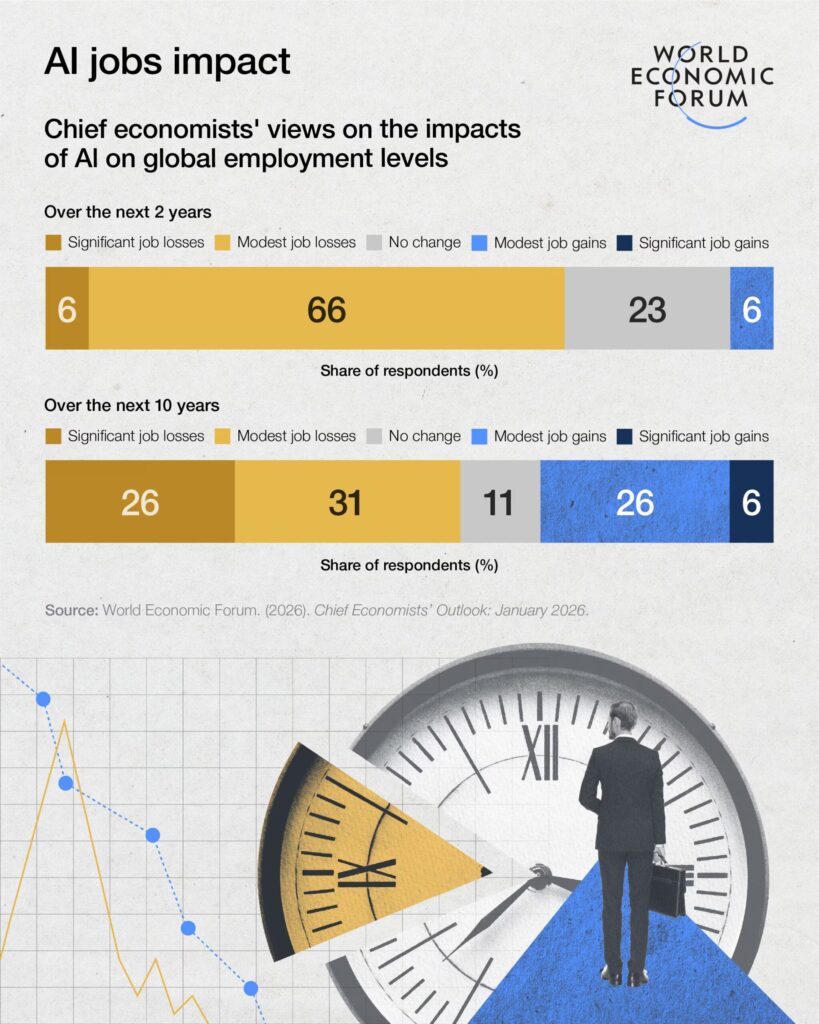

The WEF’s own Chief Economists’ Outlook reinforces this view, finding “broad anticipation of a puncturing of AI-related stock prices in the US”.

However, Donovan offers some reassurance, suggesting that the fallout will likely be less severe than the 2008 global financial crisis. He predicts that while the US dollar may weaken and US economic exceptionalism could be challenged, established technology companies with diverse business models will likely limit the scale of unemployment.

Despite the looming financial correction, AI’s economic fundamentals remain robust. The WEF report highlights that experts are “bullish” on productivity, predicting meaningful gains in major economies within the next two years.

Michael Schwarz, Chief Economist at Microsoft, highlighted the software industry as the early winner of this transformation.

“Developer productivity has surged,” Schwarz said, citing studies showing double-digit improvements. “One does not need a PhD in economics to notice the impact… A colleague recently shared that using GitHub Copilot for unit tests allowed him to complete a month’s work in just a few days.”

Rippling benefits

The benefits are expected to ripple outward into the broader economy. Gregory Daco, Chief Economist at EY, estimates that AI could lift economy-wide labour productivity by 1.5% to 3% over the next decade.

“Crucially, these gains are not being harvested passively,” Daco noted. “Most organisations are reinvesting AI-driven productivity gains into innovation, data infrastructure, and workforce upskilling.”

The reports identify specific sectors where the transformation will be most acute:

- Financial and Professional Services: AI is compressing research and workflow cycles, with major gains expected in three to five years.

- Agriculture: Máximo Torero Cullen of the FAO predicts AI will revolutionise smallholder farming by using satellite data to optimise water and fertiliser use, with results visible within two to five years.

- Software: Immediate, double-digit efficiency gains are already being realised due to fast feedback loops in coding.

The consensus at Davos suggests that a market correction may actually be a healthy, albeit painful, step toward maturity. As the “theatre and showmanship” around AI fades, Donovan argues, investors will return to economic fundamentals.

“The fact that AI has actual value should mute the economic consequences of the bubble,” Donovan concluded. “The longer-term economic fallout would likely be… more consequential than last year’s bursting of the Labubu bubble, or the 2000 crash in the price of Beanie Babies.”